Starting as a Scalp trade

We have spent a lot of time explaining why RR is important and keeping the RR as high as possible helps generate maximal profits while protecting us from risky trades due to mathematical probabilities. Under some circumstances starting a trade with a RR ratio below 2:1 is acceptable. This trading idea explains one of those.

As we already know, scalping is a trading style where traders enter and exit the market in short periods of time looking for tiny profits on each trade 15, 10, 5 or even less pips per trade.

This trading idea states that a trader could start out each trade as a scalp trade, but as the trade develops and longer time frames agree with the direction of the trade, we could turn this trade into a daytrade or even a swing trade.

We could start with a RR ratio similar to 1:1 (risking the same amount of pips we are willing to make “at the beginning of the trade”). As the trade develops and the market goes in our favor, we could turn to the longer time frames to analyze the trend, important support and resistance zones, indicators and so on. If everything agrees then we could turn that particular trade into a longer time-frame opportunity.

Not all trades will result in a swing trade though; we must make sure technical’s agree in the longer time frames.

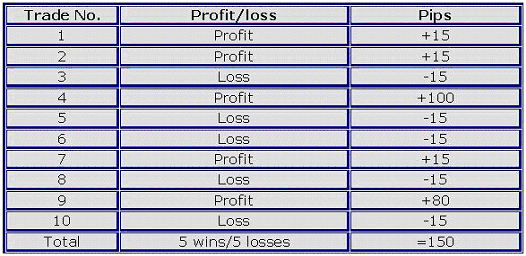

A trading account statement of a trader adopting this trading idea will look similar to this:

[Table 1]

In this particular scenario the trader is using a RR ratio of 1:1, most losses and gains are -15 and +15 respectively. The system accuracy is 50%. What makes the difference in the amount of pips gained are two trades that started out as a scalp trade but ended as a swing trade.

When we use this trading idea we could incorporate several risk and trade management techniques: a trailing stop to secure some profits and get out of the trade as the market hits our “moving stop”, we could also pyramid, etc.

Most market experts interviewed in the “Market Wizards” book written by Jack D. Schwager agree with the results above: “Most the profits will come from only 20% of your trades”. In the table above, only two trades out of ten produce most profits (80% of profits).

This trading idea works best with the GBP/USD and the USD/CAD as those two currency pairs are the most volatile amongst the majors, a run in these pairs mean a lot of pips.

This is quite an intense and stressful way of trading and does not suit all personality types – by all means give it a try; it might be the system that suits your style the best!