One contract for every $XXXXX

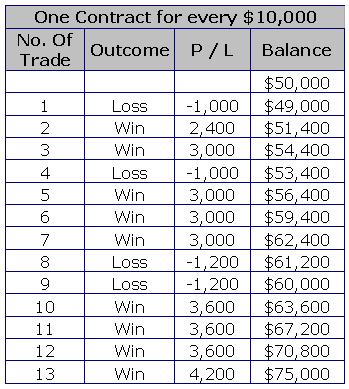

This is the most used and simplest technique. As it says in the title, this techniques simply states that the trader is going to risk one contract for every $XXXX of the traders account.

It might look a little tricky at first but bear with us as you look at the figures and you will realize it is very simple and easy to use

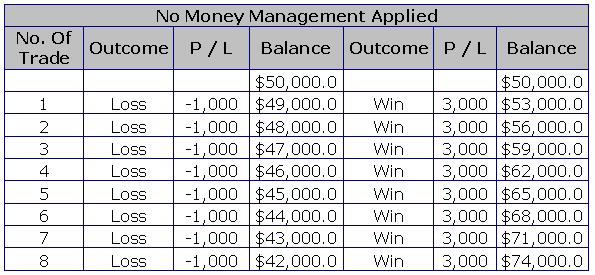

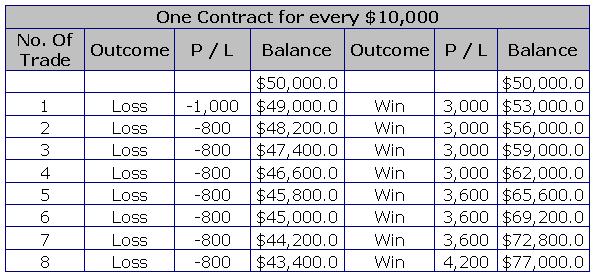

A trader opens an account with $50,000 and she decides to trade one full contract for every $10,000 on her account. On her first transaction, she is going to trade 5 lots. She only trades the EUR/USD and uses a 20 pip stop loss and a 60 pip take profit level on every trade. If she loses her first trade, her account would be at $49,000 (20 pips are worth $200 trading full lots, 20 pips x 5 lots = 100 pips = $1,000). After that trade, she will trade only 4 lots. On the other hand, if she wins her first trade, she will still trade 5 lots, because her trading account would be at $53,000 (60 pips x 5 lots = 300 pips = $3,000, she requires $7,000 more in profits in order to increase to 6 lots.

Should she face a losing streak of 8 trades, her account would be at $43,400 in contrast to the $42,000 she would have ended up with no MM at all. On the other hand, if she faced an 8 trade winning streak, she would have $77,000 in her trading account vs. $74,000 if she didn’t follow any MM at all. Not bad for just a small calculation prior to entering the position!

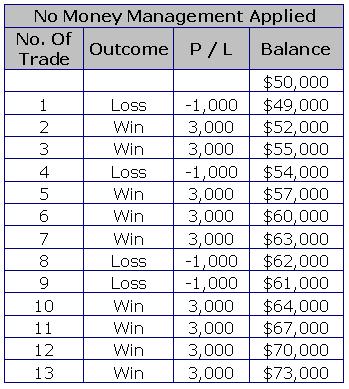

[Table 1]

[Table 2]

*It is said that a trader uses no MM technique when the same amount is risked regardless of the size of the trading account.

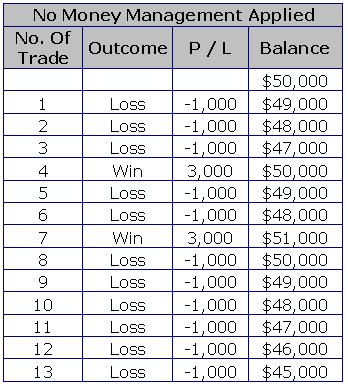

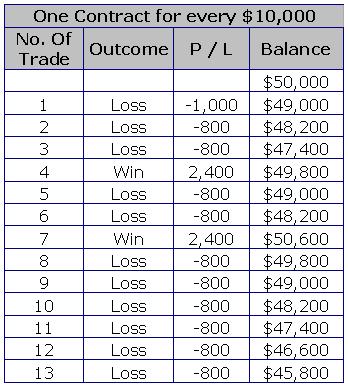

Fortunately or unfortunately real trading is not always like that, so the drawdown sequence could be as follows.

[Table 3]

[Table 4]

And the winning sequence could be as follows:

[Table 5]

[Table 6]

As you can see the difference is most noticeable on the winning side, this is because when MM is applied the balance keeps growing geometrically and the trader takes advantage of it increasing the trading size.

When these results are extrapolated over a longer time span, the difference could be much more noticeable. The difference on the winning side is $3,000 just over 13 trades, but what would it be in a 130 trade sample? Could it be $30,000? On the losing side, the difference is $1,400; could it be $14,000 over a 130 trade sample? If you spend a minute thinking about that it will bring home the point how effective good MM can be.